How Useful Is the Theory of Disruptive Innovation?

Few academic management theories have had as much influence in the business world as Clayton M. Christensen’s theory of disruptive innovation. But how well does the theory describe what actually happens in business?

The turmoil of business competition has often been likened to a stormy sea. “Gales of creative destruction,” economist Joseph Schumpeter wrote, periodically sweep through industries, sinking weak and outdated companies.1 In the mid-1990s, the winds of change appeared especially powerful, threatening even some of the strongest businesses. Enter Clayton M. Christensen, a professor at Harvard Business School who is now considered one of the world’s leading experts on innovation and growth. In his 1997 book, The Innovator’s Dilemma, Christensen provided an explanation for the failure of respected and well-managed companies.2 Good managers face a dilemma, he argued, because by doing the very things they need to do to succeed — listen to customers, invest in the business, and build distinctive capabilities — they run the risk of ignoring rivals with “disruptive” innovations.3

Christensen’s theory of disruptive innovation has gripped the business consciousness like few other ideas. In a review of enduring business books, The Economist called the theory “one of the most influential modern business ideas.”4 Other commentators have noted that the theory is so widely accepted that its predictive power is rarely questioned.5 The theory’s influence has spread far beyond the business world. Christensen and his associates have proposed disruption as a framework for thinking about vexing social problems such as poverty, lack of access to health care, illiteracy, and unemployment.6 The theory, or variations thereof, has been used in so many settings that Christensen himself has expressed unease with some of the ways the theory is being applied. In an interview with the editor-in-chief of the Harvard Business Review, he said, “I never thought … that the word disruption has so many connotations in the English language, that people would then flexibly take an idea, twist it, and use it to justify whatever they wanted to do in the first place.”7 So, what is the right way to use the theory of disruptive innovation? What are its core elements, and how predictive is it? We decided to examine these questions by taking a closer look at the theory.

Our first discovery was that, despite the theory’s widespread use and appeal, its essential validity and generalizability have been seldom tested in the academic literature. Christensen’s initial research, which formed the kernel of the theory, was based mainly on the hard disk drive industry in the 1970s and 1980s.8 He then published a few peer-reviewed articles on the industry.9 Other scholars have published discussions of related case examples (notably about Polaroid Corp., Smith Corona, and the disk drive industry),10 but few quantitative tests have been performed.11 The ones that have been published fail to provide confirmatory evidence for the theory, suggesting instead that full-blown disruptions of the type that Christensen describes are rare and that most managers respond effectively to potentially disruptive threats.12 In his defense, Christensen has said that the lack of numerical support is the result of the blunt measures used in statistical analysis.13 More nuanced case analysis, he argues, shows that the theory of disruptive innovation explains the failure of leading businesses, time after time and industry after industry.

Spurred on by this argument, we decided that to understand how to apply the theory of disruptive innovation, we needed to delve into the case histories of dozens of disruptions identified by Christensen and his coauthor, Michael E. Raynor.14 In order to examine the numerous examples and appreciate their nuances, we surveyed and interviewed one or more experts on each of 77 cases discussed in The Innovator’s Dilemma and The Innovator’s Solution, where Christensen and Raynor lay out the elements of the theory.15 (See “Sample of 77 Disruptive Innovations.”) To encourage unbiased responses, we granted all respondents anonymity. (See “About the Research.”)

After interviewing experts on each case, we had a further discovery: Many of the theory’s exemplary cases did not fit four of its key conditions and predictions well. A handful corresponded well with all four elements (notably, for example, the disruptions by Salesforce.com, Intuit’s QuickBooks, and Amazon.com). However, a majority of the 77 cases were found to include different motivating forces or displayed unpredicted outcomes. Among them were cases involving legacy costs, the effect of numerous competitors, changing economies of scale, and shifting social conditions. Discussions with our industry experts also helped us to identify the most generally applicable elements of the theory of disruptive innovation as well as to define other ways managers can guide businesses through stormy times.

Four Key Elements of the Theory of Disruptive Innovation

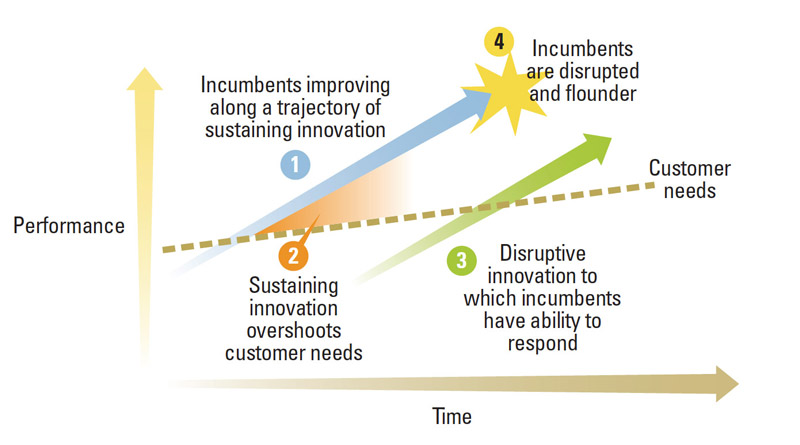

Before surveying and interviewing experts on each of the 77 cases, we identified four key elements of the theory of disruption: (1) that incumbents in a market are improving along a trajectory of sustaining innovation, (2) that they overshoot customer needs, (3) that they possess the capability to respond to disruptive threats, and (4) that incumbents end up floundering as a result of the disruption.

1. Incumbents are improving along a trajectory of innovation.

Four Elements of the Theory of Disruptive Innovation

This illustration shows four important elements of the theory of disruptive innovation: (1) sustaining innovation, (2) overshoot of customer needs, (3) the emergence of a disruptive innovation to which incumbents have the ability to respond, and (4) incumbent firms floundering as they are disrupted. Following Christensen and Raynor, we collapse the multiple value dimensions of existing products to just one dimension labeled “performance.” We also show customer needs as a line, although in fact there is a distribution of needs.

In The Innovator’s Solution, Christensen and Raynor argue that one of the key elements of disruptive innovation is that “in every market there is a distinctly different trajectory of improvement that innovating companies provide as they introduce new and improved products.”16 An incumbent business’s improvement trajectory results from what they call “sustaining innovation” — “the year-by-year improvements that all good companies grind out.”17 (See “Four Elements of the Theory of Disruptive Innovation.”) Usually, the sustaining innovations improve the products in a few established value areas. For example, auto companies might continue improving the horsepower or torque of their engines. As Christensen and Raynor explain, good managers strive “to make better products that they can sell for higher profit margins to not-yet-satisfied customers in more demanding tiers of the market.”18

2. The pace of sustaining innovation overshoots customer needs.

A second element of Christensen and Raynor’s theory is that the pace of sustaining innovation along the trajectory of particular value propositions “almost always outstrips the ability of customers in any given tier of the market to use it. … Thus, a company whose products are squarely positioned on mainstream customers’ current needs will probably overshoot what those customers are able to utilize in the future.”19 To illustrate their point, Christensen and Raynor use an example from the 1983 computer industry, “when people first started using personal computers for word processing. Typists often had to stop their fingers to let the Intel 286 chip inside catch up. … But today’s processors offer much more speed than mainstream customers can use.”20

3. Incumbents have the capability to respond but fail to exploit it.

Christensen and Raynor claim that incumbent companies frequently possess the capabilities needed to succeed, but managers fail to employ them effectively to combat potential disruptors.21 “Disruption has a paralyzing effect on industry leaders,” they write. “With resource allocation processes designed and perfected to support sustaining innovations, they are constitutionally unable to respond.”22 Competitors with disruptive innovations lull incumbent companies into complacency by avoiding a head-to-head competition for the incumbents’ best customers. They target instead new and low-end customers, Christensen and Raynor note, with “products and services that are not as good as [those] currently available.”23 Although inferior when measured against the value propositions on which sustaining innovation has been focused, these disruptive products have other attributes: They are simpler, more convenient, and less expensive. Because an incumbent company’s existing activities “determine its perceptions of the economic value of an innovation [and] shape the rewards and threats,” Christensen and Raynor argue, managers fail to appreciate and address the potential threat.24 If the disruption appears in a new market, incumbent businesses “ignore the attackers”; if among low-end customers, they “flee the attack.”25

4. Incumbents flounder as a result of the disruption.

Christensen writes that his original research goal was the development of a “failure framework” for “why and under what circumstances new technologies have caused great firms to fail.”26 He does not specify the exact probability of failure, but he leaves little doubt it is very high. “Performance oversupply,” he writes in The Innovator’s Dilemma, “opens the door for simpler, less expensive, and more convenient — and almost always disruptive — technologies to enter.”27 Companies with these disruptive technologies, he writes, “will always improve their products’ performance and in so doing eventually take over the older markets.”28 “Once the disruptive product gains a foothold in new or low-end markets,” Christensen and Raynor write, “the disruptors are on a path that will ultimately crush the incumbents.”29

What the Experts Reported

We intentionally did not mention disruptive innovation until the end of our discussions with experts in order to elicit unbiased responses. For many of the cases, experts reported historical evidence that corresponded with some elements of the theory. For example, consistent with Christensen and Raynor’s claim that managers tend to “ignore” low-end disruption, an author of a book on the history of book retailing told us that higher-end bookstores had initially discounted the threat of mall-based stores.30 Similarly, a historian of publishing told us that managers of photo-offset printing companies had doubted that digital printing would ever deliver the speed and quality needed to compete.31 In many other interviews, however, the experts pointed out noteworthy discrepancies between case facts and elements of the theory.

Not all cases included sustaining innovation.

In 24 cases (31% of the total), our experts were skeptical of the existence of any meaningful trajectory of sustaining innovation prior to the emergence of a presumably disruptive innovation (for instance, market retailing before department stores, bazaars before eBay, and four-year colleges before community colleges).32 The case of large-scale meatpacking provides a good example of such an exception. Christensen and Raynor write that “in the 1880s, Swift and Armour began huge centralized operations that transported large sides of beef by refrigerated railcars.” They further claim that “this disrupted local slaughter operations.”33 But our experts, both book authors on the history of meatpacking, were skeptical that “sustaining innovation” was, as implied by the theory, a meaningful part of the story. Local butchers, they pointed out, were not on a trajectory of innovation.34 To the contrary, they relied on tools and artisanal practices that hadn’t changed for decades. Local slaughter operations were replaced, the experts argued, because of broader changes: the Union Army’s demand for beef during the American Civil War, the expansion of the railroads, the scale economies provided by the use of a “disassembly line,”35 and opposition by local communities that wished to see noxious slaughter operations closed.36

Not all incumbent companies overshot customers’ needs.

In 60 cases (78% of the total), and contrary to the expectations of the theory, our experts thought that incumbent companies were not producing, or likely to produce, products or services that exceeded customer needs. For example, hand animation was replaced by computer animation not because it outstripped what customers wanted, but because it was too expensive. In the case of local area networks, data rates increased rapidly, but customers kept pace by developing ways to use the increased bandwidth. In the cases of Internet search engines’ replacement of print directories, two professors at top-ranked business schools were skeptical that print directories such as the Yellow Pages had surpassed anyone’s needs.37 Rather, the print directories were displaced, one expert noted, because companies producing them simply didn’t have the ability to respond: “There are certain situations where the economics … just don’t let reasonable managers respond in a way that would disrupt the disruptor.”38 In other cases, experts noted that overshoot was difficult to achieve. For example, when discussing whether surgery had overshot customer needs, thereby enabling disruption by endoscopy, an M.D. and expert on the business of health care asked, “What would such overshoot look like: too little risk of death?”39

Prior to initiating our study, we anticipated that overshoot would be common in cases involving the computing industry, such as computer software or hardware. But our experts (made up of computer scientists, historians, and business professors) suggested that even here overshoot was infrequent.40 They acknowledged rapid growth in computing power driven by Moore’s law (the observation by former Intel cofounder Gordon E. Moore that the number of transistors on an integrated circuit doubles approximately every two years). But they were doubtful that this led to neglect of average or low-end consumers. Incumbent companies, one expert noted, often use computing power to serve the needs of new, less-savvy customers — not to overshoot customer needs.41 Apple Inc., for example, launched its original Macintosh in 1984 with a powerful central processing unit to enable a user-friendly graphical interface.

Many incumbents were incapable of responding to the potential disruption.

In 30 cases (39% of the total), our experts disputed Christensen’s contention that incumbent businesses were capable of responding to the disruptive innovation. In some cases, experts argued, incumbents were restricted, even barred, from using their capabilities to respond. For example, in legal education, Christensen points to the weak response of incumbent law schools to online legal training. But there are clear limits to how far incumbent law schools can go in exploring potentially disruptive online legal education. In the United States, the American Bar Association restricts the number of hours of online courses law schools can offer without losing their accreditation and jeopardizing the ability of their graduates to take the bar exam.42 Similarly, until 1978, U.S. airlines were restricted from competing on price.43

In other cases, our experts doubted that incumbent organizations possessed the capabilities needed to compete with a disruptive entrant. Christensen and Raynor imply that national postal services (for example, the U.S. Postal Service and Canada Post) could have — and should have — protected their positions in mail delivery from the likes of AOL Inc. by offering their own email services.44 However, an expert was skeptical about the practicality of this plan, pointing out that, for the most part, executives running the postal services had very little control over labor practices and price structures.45 Moreover, beating AOL would have required accessing new capabilities and resources that public post offices didn’t have. A similar argument can be made concerning the wood-products industry, many of whose products have been disrupted by plastics. Christensen suggests that wood-product companies should have anticipated the threat from plastic producers. However, a professor at a leading engineering school told us it was unreasonable to assume that companies with skills in silviculture and sawmill technology had the capability to compete effectively against “disrupting” producers of plastics.46

Approximately one-third of incumbents were not displaced by a new technology.

Christensen says that disruptive innovators displace incumbent leaders “nearly every time.” Our experts were not as convinced. They agreed that in about 62% of the cases, incumbents floundered as a result of a disruptive competitor. However, in the remaining 29 cases (38%), there were a range of outcomes. In some cases (for example, credit scoring and business lending),47 disruptions complemented incumbent businesses by supporting their existing actions. In other cases, disruptions coexisted with incumbent businesses or allowed them to reach untapped customers (for instance, catalog sales and department stores). In still others, disruptions have continued to serve different markets (for example, physical and online law schools).48

How Well Do the Cases Match the Theory?

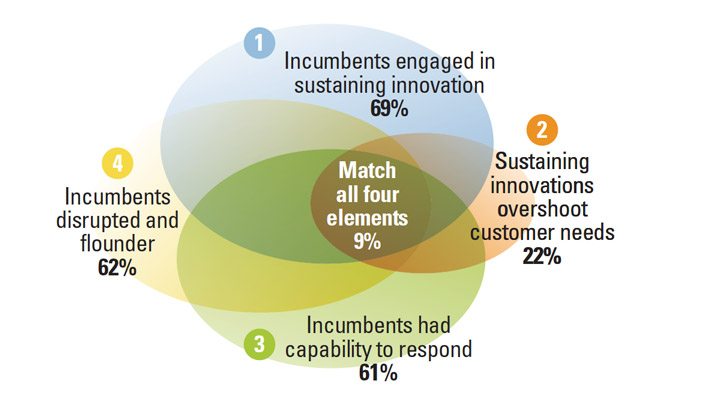

This Venn diagram maps the 77 examples listed in The Innovator’s Dilemma and The Innovator’s Solution and shows the extent to which, in the opinion of industry experts, they exhibit each of four key elements of the theory. Using the industry experts’ assessments, only seven of the cases (9%) exhibited all four elements of the theory.

In summary, although Christensen and Raynor selected the 77 cases as examples of the theory of disruptive innovation, our survey of experts reveals that many of the cases do not correspond closely with the theory. In fact, their responses suggest that only seven of the cases (9%) contained all four elements of the theory that we asked about. (See “How Well Do the Cases Match the Theory?”) How can we account for this discrepancy? Clearly, analysis of the cases is open to interpretation, and one or more of our experts may be mistaken in their judgment of a particular case. But even several random errors, given the large number of experts surveyed, would not significantly change our main findings. At least, our findings suggest, we should consider what else could be going on.

Problematic Assumptions

We concluded each of our interviews by disclosing the subject of our study and asking the expert to reflect on the theory’s usefulness in understanding the case at hand. These conversations highlighted several assumptions that limit the application or predictive power of the theory of disruptive innovation.

The Goal

Some of our experts noted confusion about the presumed goal of a business or organization. Christensen’s early work seems to imply that companies should try to maintain market share. Experts familiar with this work noted that such an assumption could lead to strategies that maintained market share while harming profits. In response to such criticism,49 Christensen clarified his position in a 2006 publication, writing that he “had simply assumed that the objective function of management should be to maximize shareholder value.”50 This clarified objective is problematic for the 9% of cases we examined that represent nonprofit organizations or publicly regulated utilities. For example, an author and expert on higher education noted that the “access mission of community colleges often runs counter to what presidents or other leaders might do to cut costs or improve completion outcomes.” This expert adds: “That makes it not such a great example for the theory [because] as a mission-driven institution, they are responsible to the public and a higher calling.”51

Relative Rates of Improvement and Utilization

Christensen’s theory of disruption involves critical assumptions about the rate of “sustaining innovation.” As described by Christensen and Raynor, the theory assumes that “in almost every industry,” sustaining innovation “outstrips the ability of customers in any given tier of the market to use it.”52 The resulting “overshoot of what customers can utilize,” they write, “opens the door” for a disruptive innovation.53 Many of our experts identified problems with this assumption.

Sustaining innovation can be too slow to keep up with growing customer needs. For example, new improvements in wood materials failed to keep pace with growing construction requirements. Likewise, even with the development of new processing technologies, many postal services failed to satisfy growing customer demands for speedy home delivery. In addition, customer needs often respond to better performance, altering behavior and, in turn, one’s perception of needs. Today, for example, many of us feel we “need” to carry around what are in effect supercomputers that take pictures and allow us to chat with our friends.54 In some cases, one expert pointed out to us, user needs seem to be insatiable.55 What would it mean, she asked, if food was too healthy, shelter too available, or education too effective?

Relative Rates of Improvement of Sustaining and Disruptive Technologies

When both disruptive and sustaining innovations compete to satisfy ever-increasing customer demands, the relative rate of improvement may be important. Our experts noted several cases where disruptive innovation had sputtered or where older technologies had improved so quickly that new technologies were eclipsed. For example, in 2003, Christensen and Raynor predicted that ultrasound technology would disrupt radiation imaging.56 However, the opposite has occurred. Innovations in radiation imaging (for instance, X-ray tomography), followed by nuclear magnetic resonance imaging (MRI), have relegated the use of ultrasound to specialized applications such as prenatal care. Our expert, the head of medical imaging at a major U.S. hospital, claimed that in the foreseeable future there was “no chance” ultrasound would displace radiation technologies.57

The threats faced by the companies in our sample were deeply challenging, and they cannot be understood from a single viewpoint.

Indeed, the assumption that “disruptive” innovations always beat “sustaining” ones has led Christensen to make a number of erroneous predictions. For example, in an early publication, Christensen and Joseph L. Bower claimed that disk drive companies were ignoring the 1.8-inch disk drives in a manner “eerily familiar” to what had happened following the emergence of previous formats. They suggested that companies sticking with the larger 2.5-inch format would be displaced by new competitors.58 When Gary Marks, then vice president for disk drive marketing at hard drive manufacturer Conner Peripherals, publicly disagreed, Christensen and Bower replied that Marks was making “exactly the mistake we warn against.”59 Eventually, though, Marks was proven right: Today, 2.5-inch and 3.5-inch disk drives dominate the industry, and 1.8-inch drives are no longer produced.

Incumbents’ Ability to Respond

Joseph Schumpeter argued that waves of “creative destruction” were a vital part of any economy because they washed away businesses with obsolete capabilities. By contrast, Christensen argues that leading companies often have the resources and abilities needed to succeed but lack the values, modes of interaction, and decision making to do so.60 However, such confidence is belied by the trials encountered by many of the 77 cases we studied. Several of the companies had to navigate fundamental transitions in technology (for example, from flat-glass to roll-film photography, or travel agents to online services), and others had to make the difficult transition from analog to digital technologies (for instance, from vacuum tubes to liquid crystal displays, physical mail to email, hand drawing to digital animation). These technological shifts can be treacherous, because they involve different engineering skills, new product designs, and new production facilities.61

Managers Satisfying Existing Customers

Christensen and his collaborators argue that managers are doing an excellent job satisfying their high-margin customers in their existing business but are myopic about the threats posed by low-end customers or new markets. In fact, in several of the cases we examined, poor management left even high-end customers dissatisfied. For example, by the time Honda Motor Co. entered the United States with a line of inexpensive offerings for the U.S. motorcycle market, Harley-Davidson Motor Co. was already being criticized by some of its customers for poor reliability.62 Likewise, before slaughterhouses were disrupted by boxed beef, they already had been criticized for being unsanitary.63 And many people complain about the post office.

Christensen assumes that managers are myopic when it comes to making good choices about new markets created by disruptive innovations. Not so, the director of a research program on corporate strategy and innovation told us. His own research and that of others showed that most managers made choices that were aligned with their capabilities. Businesses with the capabilities needed to compete tended to adopt disruptive innovations. Weaker businesses tended to “play out their hands” by maximizing their returns in declining existing markets. “On average,” he said, “managers make the right choices.”64

In several cases, the right choice for an incumbent may have been to avoid competing with a disruptive innovation. Speaking of the airline industry, for example, one expert said, “The biggest contrast between the Christensen model and what happened with the airlines is that [Christensen says] the barrier is somehow cognitive. … [In fact] there are fundamental structural barriers.”65 Switching to a low-cost, point-to-point airline business model would have required a dramatically different fleet of airplanes, new workers, new airports, and new gates. “Sometimes [stuff] happens,” he argued, “and the best response is to adapt but not dramatically change the business model.”66 A business professor and expert on digital electronics made a similar point about the transition from television tubes to digital displays. He noted Sony Corp.’s losses in the display market and argued that managers should have recognized their lack of advantages and “prepared to exit” rather than fighting to defend Sony’s position.67

Other Factors at Work

Is there a better explanation than the theory of disruption for the patterns of success and failure across the 77 cases Christensen and Raynor cite? Having argued that one theory is not adequate for explaining so many diverse cases, we are cautious about overreaching. Nevertheless, from our conversations with academics and industry experts, we have identified some rough patterns that could provide a starting point. These patterns revolve around legacy costs, changing scale economies, and the laws of probability.

Legacy Costs

Several companies that Christensen and his collaborators say were “disrupted” by new innovations were already severely weakened by legacy costs in the form of investments and contracts. For example, U.S. steel company managers, protected from foreign competition by trade legislation, agreed to labor contracts that included expensive health care and pension provisions. When trade barriers fell, the costs became unsupportable. In a postmortem of Bethlehem Steel Corp., Fortune writer Carol Loomis explained the deadly spiral as “a demographic nightmare, in which an ever-shrinking number of active employees were charged with making profits sufficient to support the present and future of an ever-growing number of retirees and dependents.”68 Managers faced a nearly impossible task. When Loomis asked former General Electric Co. CEO Jack Welch if he could have saved Bethlehem Steel, he replied, “I don’t think Christ could have done it.”69 Our experts told us that such legacy costs played a similarly critical role in several other cases, including automobiles, motorcycles, food processing, and transportation.70

Changing Scale Economies

In at least 40% of the 77 cases, changing business conditions increased the economic advantages of scale and thereby limited the number of businesses that could profitably serve the market. The resulting “disruption” was really a well-known economic process that selected for a few well-placed businesses, incumbents and entrants alike, that could best leverage scale economies. For example, we mentioned earlier that the expansion of national railroads allowed a few meatpacking plants to harness economies of scale and drive down costs. Previously, such scale advantages had been constrained by the inability to ship meat long distances, but the expansion of railroads and the availability of railcars with ice removed these barriers. These developments allowed meatpackers near major rail hubs to harness massive scale economies and distribute inexpensive meat to broad regions of the country.71

In recent decades, the development of the Internet and reliable parcel delivery has created similar scale challenges for brick-and-mortar bookstores. Before the tremendous growth of e-commerce, Borders Group Inc. and Barnes & Noble Inc. leveraged economies created by the superstore format to gain a competitive advantage over smaller bookstores and mall-based chains.72 Online technologies meant that the assets represented by superstores could be trumped by an enormous, largely centralized distribution system. Because online sales costs continually fell with volume, whoever gained an initial advantage was likely to take the entire market; it didn’t matter whether it was a startup or an incumbent. Changing scale economies turned legacy investments in superstores into a liability. A professor at a leading U.S. business school told us, “[T]he problem for Borders was that they needed all of their customers, and so when Amazon started to siphon them off they simply couldn’t cover fixed costs.”73

When network externalities provide a broad scale advantage, some businesses are faced with a winner-take-all competition. Economist W. Brian Arthur has demonstrated that in such competitions, a few early sales can initiate a feedback loop of network advantage that tips all customers to one supplier.74 Microsoft DOS became the dominant operating system for personal computers because IBM’s imprimatur suggested that others would adopt the operating system.75 To gain future scale economies, customers joined the DOS standard, further entrenching Microsoft’s position. Eventually, the scale benefits became so great that even superior operating systems such as Apple’s MacOS could not gain significant market share.

The Laws of Probability

Sometimes incumbents are simply outnumbered by the sheer quantity of new competitors. In at least 30% of the 77 cases we considered, new infrastructure and changing demographics caused an expansion of business opportunities and a “gold rush” search for the best business models. Incumbent companies participated in this rush just as readily as new entrants, and they often picked what appeared to be good claims. Because of their numbers, however, new entrants were able to cover more ground in the aggregate. The laws of probability thus said that in most cases new entrants would stake the best claims and be the biggest winners.

For example, the construction of highways following World War II greatly stimulated the development of “roadside America.”76 New forms of service franchising inspired hundreds of food service chains to enter the market with different offerings and business models.77 So many investors rushed in that speculators even created financial instruments for investing in franchise models. As with any gold rush, fundamental economics eventually forced a shakeout. Although many of the old chains (such as Howard Johnson’s and Dairy Queen) managed to survive, some of the new companies (such as McDonald’s and Burger King) proved to have selected better franchise models and eventually emerged as the biggest winners.

The same pattern was repeated with the rise of the Internet. Because online business required little investment in physical assets, almost anyone could start an online company. Thousands of entrepreneurs rushed in to explore every imaginable idea. Existing businesses once again explored promising new business models, but because they were fewer in number, they couldn’t stake as many claims as the swarms of entrepreneurs. Although the majority of online startups would ultimately fail, their sheer numbers meant that some of them would strike it rich.78

Using the Theory of Disruptive Innovation

The threats faced by the companies in our sample were deeply challenging, and they cannot be understood from a single viewpoint or solved by a single prescription. Instead, managers need to evaluate difficult problems from a number of different perspectives. In that spirit, we do not advocate discarding the theory of disruption. Rather, we recommend using its best parts in addition to classical approaches to strategic analysis.

The theory of disruptive innovation provides a generally useful warning about managerial myopia. Many of our experts noted examples of managers who overlooked or misunderstood the importance of an emerging threat. A professor of business innovation told us, for example, that managers working in relationship management software had overlooked the threat posed by Salesforce.com. In many other cases, managers in incumbent companies misunderstood the value of innovations by rivals. Suppliers such as Swift and Armour discounted boxed beef because the meat was frozen, and they had previously failed in their own attempts at frozen beef. Later, according to an industry historian who has chronicled this story, “they all slapped their foreheads … and said, ‘Oh man, we really screwed up back then.’”79 Similarly, although managers at Xerox didn’t completely neglect the market for self-service copiers, they do seem to have misunderstood the value of Canon’s dry-toner innovation in reducing service costs and customer inconvenience.80 In summary, we believe that the theory of disruptive innovation provides a useful reminder of the importance of testing assumptions, seeking outside information, and other means of reducing myopic thinking.

Yet our discussions with experts suggest that the full theory of disruptive innovation should only be applied when specific conditions are met. Christensen’s theory was inspired by an industry that he admits is highly unusual; as he wrote, “nowhere in the history of business has there been an industry like disk drives, where changes in technology, market structure, global scope, and vertical integration have been so pervasive, rapid, and unrelenting.” He suggests that few other industries “offer researchers the same opportunities for developing theories.”81 Perhaps so, but the theory’s unusual birthplace suggests the need for an evaluation of similarities between the disk drive industry and any setting where theory is to be applied. One business school professor told us, “Here is what I tell my students who label everything a disruption. Where is the improvement curve? Because the fundamental assumption of the theory is that the improvement curve [the rate of sustaining innovation by incumbents] is going up faster than the consumer’s ability to absorb those improvements.”82 This assumption is critical, the professor explained, because it drives vital parts of the theory of disruption, such as the expectation that disruptive threats will emerge among low-end, overserved customers.

Even when there is a rapid improvement curve and potential for the improvement to exceed customer needs, the theory of disruptive innovation should be considered a warning rather than a prediction. The theory describes case examples of dysfunction and failure, not what the average business may do. For example, an expert in a top-rated technical school told us that his research on the disk drive industry suggested that the case of one disk drive company, Seagate Technology Inc., indeed matched the theory of disruption. Seagate does seem to have overlooked the value of emerging 3.5-inch disk drives, and as a result, it was temporarily displaced from leadership in the industry. Yet most of the time, Seagate and other companies responded effectively to presumably disruptive threats.83 Thus, the theory provides a good reminder of potential pitfalls, he argued, but in no way does it predict what most companies will do.

A telling example of how risky it can be to use the theory to predict the behaviors of incumbent companies can be found in a teaching case, coauthored by Christensen himself, describing a startup company with an idea for developing a very thin camera. The company’s management knew it could not compete with established companies if they chose to make a similar product. However, management hoped that the “disruptive” nature of the company’s “credit card camera” would cause big players to ignore them. Unfortunately, an established competitor noticed the product and jumped into the market with a superior offering.84 Contrary to what the theory predicted, the startup, not the incumbent, was driven from the market.

What Should Managers Do?

Given the evidence that the theory has limited predictive power, how should managers react to the appearance of potential new rivals? We propose a fairly straightforward diagnostic based on authenticated modes of analysis. First, managers should calculate the value of winning. Second, they should find ways to leverage existing capabilities. And finally, where practical, they should work collaboratively with other companies.

Calculate the value of winning.

Christensen and his collaborators seem to assume that no matter what industry or market a company is in, it should fight to maintain control. But this is folly. In many of the 77 cases, factors such as low barriers to entry, the emergence of substitutes, and an increase in the number and aggressiveness of rivals turned once-profitable industries into profitless deserts. Indeed, choosing to fight without studying the options violates a basic principle of strategy: The first step in responding to any major innovation is assessing whether the industry continues to be an attractive place to compete. When industries become structurally unattractive, it may be time to plan an organized retreat.

Harvard Business School professor Willy C. Shih has studied the challenges that businesses with analog technologies faced in responding to new digital technologies. “Such transitions are competency-destroying,” he writes, because “the capabilities, tacit knowledge, and experience base of the incumbent analog firms are rendered irrelevant.”85 He adds, “While the firms may still possess valuable complements like brands or sales and distribution channels, such transitions are immensely challenging because of the exposure to commoditization.”86 Digital technologies often cause barriers to entry to fall and competition to become cutthroat. As a result, Shih argues, companies should evaluate the potential for profits in a new market before they jump in.

Leverage existing capabilities.

Managers should analyze how their existing capabilities can be deployed most profitably.87 If current capabilities can be used or extended, it may make sense to expand into a new market. Amazon.com Inc., for example, expanded from books to other vertical markets where it was able to command some advantage from online sales. However, companies need to pay attention to the potential synergies between existing and new businesses.

Our discussions with experts suggest that the full theory of disruptive innovation should only be applied when certain conditions are met.

Sometimes choosing the right way to use capabilities means reconsidering the existing identity of the organization.88 Consider the case of Eastman Kodak Co. According to popular opinion, Kodak failed because it didn’t move aggressively and effectively enough into digital imaging. Fujifilm Holdings Corp., according to this view, succeeded because it developed a successful line of digital cameras. However, the reality is that this version of the story is a myth. Fujifilm survived not because it developed a new line of digital cameras but because it used its capabilities in chemicals and information technology to develop successful products and services in coatings, cosmetics, and document processing. Fujifilm continues to make a few cameras, but it barely recoups its operating costs.89 It is prospering not because it defended its position in imaging, but because it expanded into other areas.

Work collaboratively with other companies.

The prospect of an entrepreneur with new technology potentially disrupting incumbent businesses can make managers wary of cooperating with entrants. In several of the cases we explored, however, incumbents recognized the potential for working with new entrants. The Walt Disney Co., for example, responded to the emergence of computer animation by cooperating with and eventually acquiring Pixar Animation Studios. Disney could have continued to compete with Pixar and tried to drive it from the market, but Disney managers wisely recognized that their company’s strengths were in marketing, distribution, and creating positive experiences at parks, cruise ships, and resorts; Pixar, by contrast, was a content developer.90 Many pharmaceutical companies routinely use a range of approaches, including cooperation, when facing competition from biotech startups. Rather than seeing every biotech company as a potential disrupter, pharmaceutical company executives often cooperate with biotech startups to leverage their own strengths.

There is nothing radical about employing such classic approaches to strategic analysis. Indeed, good analysis often is based on old-fashioned spadework and careful consideration. Assessing new threats requires considering multiple perspectives, reflecting on one’s own biases, and a willingness, if necessary, to jump into the unknown. Faced with the prospect of this leap, managers may be tempted to turn to the theory of disruption, as Christensen himself says, “to justify whatever they wanted to do in the first place.”91 But doing so is an excellent way to cede your business’s competitive advantage to more competent competitors.

In summary, stories about disruptive innovation can provide warnings of what may happen, but they are no substitute for critical thinking. High-level theories can give managers encouragement, but they are no replacement for careful analysis and difficult choices. Should a company stay in the fight in a particular market and incur the cost of doing so, or should it exit the market and see those revenues vanish? Should a company invest in a profitable but declining business, or should it turn away? Is the best course to maximize returns by letting the business slowly die? These are heart-wrenching choices. Following simple theories or using quick analogies may provide a sense of certainty, but they are no substitutes for careful, fundamental analysis of the nature of competition and the sources of competitive advantage.

References

1. J.A. Schumpeter, “Capitalism, Socialism, and Democracy” (London: Routledge, 2003, first published in 1942 by Harper Perennial); and J.A. Schumpeter, “The Theory of Economic Development: An Inquiry Into Profits, Capital, Credit, Interest, and the Business Cycle” (New Brunswick, New Jersey: Transaction Publishers, 1934).

2. C.M. Christensen, “The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail” (New York: HarperCollins, 2003, first published in 1997 by Harvard Business Review Press).

3. Ibid.

4. “Aiming High,” June 30, 2011, www.economist.com.

5. J. Lepore, “The Disruption Machine: What the Gospel of Innovation Gets Wrong,” New Yorker, June 23, 2014; and A. Saunders, “Is Disruptive Innovation Dead?” September 29, 2014, www.managementtoday.co.uk.

6. C.M. Christensen, J.H. Grossman, and J. Hwang, “How to Heal the Health Care System,” Forbes, October 31, 2008, 81-85; C.M. Christensen and D. van Bever, “The Capitalist’s Dilemma,” Harvard Business Review 92, no. 6 (June 2014): 60-68; S.L. Hart and C.M. Christensen, “The Great Leap: Driving Innovation From the Base of the Pyramid,” MIT Sloan Management Review 44, no. 1 (fall 2002): 51-56; and C.M. Christensen, M.B. Horn, and C.W. Johnson, “Disrupting Class: How Disruptive Innovation Will Change the Way the World Learns” (New York: McGraw-Hill, 2008).

7. “Clay Christensen on the Recent Debate Surrounding His Theory of Disruptive Innovation,” interviewed by Adi Ignatius, June 27, 2014, www.youtube.com.

8. C.M. Christensen and J.L. Bower, “Customer Power, Strategic Investment, and the Failure of Leading Firms,” Strategic Management Journal 17, no. 3 (March 1996): 197-218.

9. C.M. Christensen, “The Rigid Disk-Drive Industry: A History of Commercial and Technological Turbulence,” Business History Review 67, no. 4 (winter 1993): 531-588; Christensen and Bower, “Customer Power”; and C.M. Christensen, F.F. Suarez, and J.M. Utterback, “Strategies for Survival in Fast-Changing Industries,” Management Science 44, no. 12, part 2 (December 1998): S207-S220.

10. M. Tripsas and G. Gavetti, “Capabilities, Cognition, and Inertia: Evidence From Digital Imaging,” Strategic Management Journal 21, no. 10-11 (October-November 2000): 1147-1161; E. Danneels, “Trying To Become a Different Type of Company: Dynamic Capability at Smith Corona,” Strategic Management Journal 32, no. 1 (January 2011): 1-31; and D.G. McKendrick, R.F. Doner, and S. Haggard, “From Silicon Valley to Singapore: Location and Competitive Advantage in the Hard Disk Drive Industry” (Stanford, California: Stanford University Press, 2000).

11. E. Danneels, “Disruptive Technology Reconsidered: A Critique and Research Agenda,” Journal of Product Innovation Management 21, no. 4 (July 2004): 246-258.

12. McKendrick, Doner, and Haggard, “From Silicon Valley”; A.A. King and C.L. Tucci, “Incumbent Entry Into New Market Niches: The Role of Experience and Managerial Choice in the Creation of Dynamic Capabilities,” Management Science 48, no. 2 (February 2002): 171-186; G.J. Tellis, “Disruptive Technology or Visionary Leadership?” Journal of Product Innovation Management 23, no. 1 (January 2006): 34-38; and A. Sood and G.J. Tellis, “Technological Evolution and Radical Innovation,” Journal of Marketing 69, no. 3 (July 2005): 152-168.

13. C.M. Christensen, “The Ongoing Process of Building a Theory of Disruption,” Journal of Product Innovation Management 23, no. 1 (January 2006): 39-55.

14. Christensen, “Innovator’s Dilemma”; and C.M. Christensen and M.E. Raynor, “The Innovator’s Solution: Creating and Sustaining Successful Growth” (Boston: Harvard Business School Press, 2003).

15. Christensen, “Innovator’s Dilemma”; Christensen and Raynor, “Innovator’s Solution.”

16. Christensen and Raynor, “Innovator’s Solution,” 33.

17. Ibid, 34.

18. Ibid., 33.

19. Ibid., 33.

20. Ibid., 34.

21. This distinguished disruption from previous theories. Scholars had long argued that companies are displaced when their capabilities become obsolete or surpassed by those of competitors. Christensen broke from this tradition by arguing that companies are displaced despite possessing the capabilities needed to succeed.

22. Christensen and Raynor, “Innovator’s Solution,” 35.

23. Ibid., 34.

24. Ibid., 44.

25. Ibid., 46.

26. Christensen, “Innovator’s Dilemma,” viii.

27. Ibid., 213.

28. Ibid., 232.

29. Christensen and Raynor, “Innovator’s Solution,” 34.

30. Anonymous expert, Barnes & Noble interview, July 28, 2015.

31. Anonymous expert, digital printing interview, July 28, 2015.

32. This might seem surprising, but our expert told us that for many years colleges focused on “opening doors to new types of students: GIs after wars, underrepresented minorities, low-income students.” The expert noted that for many years there was not any discussion of performance. Some scholars, the expert noted, were of course focused on improving research.

33. Christensen and Raynor, “Innovator’s Solution,” 56.

34. Anonymous expert, boxed beef interview, October 22, 2014; and anonymous expert, centralized beef slaughtering operations interview, October 21, 2014.

35. D. Hounshell, “From the American System to Mass Production, 1800-1932: The Development of Manufacturing Technology in the United States” (Baltimore, Maryland: Johns Hopkins University Press, 1985).

36. Anonymous expert, boxed beef interview, October 22, 2014; and anonymous expert, centralized beef slaughtering operations interview, October 21, 2014.

37. Anonymous experts, Internet search engines interviews, October 9, 2014 and October 22, 2014.

38. Anonymous expert, Internet search engine interview, October 24, 2014.

39. Anonymous expert, endoscopic surgery interview, October 1, 2014.

40. Anonymous expert, computers based on reduced instruction set computing microprocessors interview, November 24, 2014; anonymous expert, direct sales computer retailing interview, February 18, 2015; and anonymous expert, minicomputers interview, October 27, 2014.

41. Anonymous expert, Microsoft DOS interview, October 22, 2014.

42. Anonymous expert, online law schools interview, October 10, 2014.

43. Anonymous expert, discount airline (Southwest) interview, November 3, 2014.

44. Christensen and Raynor, “Innovator’s Solution.”

45. Anonymous expert, email interview, October 15, 2014.

46. Anonymous expert, plastics interview, November 14, 2014.

47. W. Scott Frame, A. Srinivasan, and L. Woosley, “The Effect of Credit Scoring on Small-Business Lending,” Journal of Money, Credit and Banking 33, no. 3 (August 2001): 813-825.

48. N. Wecker, “Weigh the Benefits, Disadvantages of Attending a Non-ABA Law School,” December 17, 2012, www.usnews.com.

49. C. Markides, “Disruptive Innovation: In Need of Better Theory,” Journal of Product Innovation Management 23, no. 1 (January 2006): 19-25.

50. Christensen, “Ongoing Process,” 50.

51. Anonymous expert, community colleges interviews, October 6, 2014, and August 26, 2015.

52. Christensen and Raynor, “Innovator’s Solution,” 33.

53. Ibid., 213.

54. This rapid expansion in consumer “needs” may explain why Christensen predicted the iPhone wouldn’t succeed. See J. McGregor, “Clayton Christensen’s Innovation Brain,” June 15, 2007, www.bloomberg.com.

55. Anonymous expert, centralized beef slaughtering operations interview, October 21, 2014.

56. Christensen and Raynor, “Innovator’s Solution.”

57. Anonymous expert, ultrasound imaging interview, October 28, 2014.

58. J.L. Bower and C.M. Christensen, “Disruptive Technologies: Catching the Wave,” Harvard Business Review 73, no. 1 (January-February 1995): 51.

59. G. Marks, “Letters to the Editor: Disruptive Technologies,” Harvard Business Review 73, no. 2 (March-April 1995): 8-9; and C.M. Christensen and J.L. Bower, “Disruptive Technologies: Reply,” Harvard Business Review 73, no. 3 (May-June 1995): 17.

60. For example, Christensen and Bower write: “Our conclusion is that a primary reason why such firms lose their positions of industry leadership when faced with certain types of technological change has little to do with technology itself — with its degree of newness or difficulty, relative to the skills and experience of the firm. … We find that firms possessing the capacity and capability to innovate may fail when the innovation does not address the foreseeable needs of their current customers.” See Christensen and Bower, “Customer Power,” 198.

61. Anonymous expert, LCDs interview, November 12, 2014.

62. H.S. Thompson, “Hell’s Angels: The Strange and Terrible Saga of the Outlaw Motorcycle Gangs” (New York: Random House, 1966).

63. M. Ogle, “In Meat We Trust: An Unexpected History of Carnivore America” (New York: Houghton Mifflin Harcourt, 2013).

64. Anonymous expert, small-format disk drives interview, October 15, 2014.

65. Anonymous expert, discount airline (Southwest) interview, November 3, 2014.

66. Anonymous expert, discount airline (Southwest) interview, August 22, 2015.

67. Anonymous expert, LCDs interview, November 12, 2014.

68. C.J. Loomis, “The Sinking of Bethlehem Steel,” Fortune, April 5, 2004, http://archive.fortune.com.

69. Ibid.

70. As this article was undergoing review, Harvard Business School professor Willy C. Shih published a blog post on Harvard Business Review’s website on the importance of legacy costs in explaining the failure of U.S. steel mills. See W.C. Shih, “Breaking the Death Grip of Legacy Technologies,” May 28, 2015, https://hbr.org.

71. Ogle, “In Meat We Trust.”

72. Anonymous expert, online book sales interview, October 24, 2014; and P. Ghemawat, B. Baird, and G. Friedman, “Leadership Online: Barnes & Noble vs. Amazon.com” (Boston: Harvard Business School Case Services, 1998).

73. Anonymous expert, online book sales interview, October 24, 2014.

74. W.B. Arthur, “Competing Technologies, Increasing Returns, and Lock-In By Historical Events,” Economic Journal 99, no. 394 (March 1989): 116-131.

75. M. Campbell-Kelly and W. Aspray, “Computer: A History of the Information Machine,” 2nd ed. (Boulder, Colorado: Westview Press, 2004).

76. J.A. Jakle and K.A. Sculle, “Fast Food: Roadside Restaurants in the Automobile Age” (Baltimore, Maryland: Johns Hopkins University Press, 2002).

77. Anonymous expert, interview on the rise of fast food, October 30, 2014.

78. B. Goldfarb, D. Kirsch, and D.A. Miller, “Was There Too Little Entry During the Dot Com Era?” Journal of Financial Economics 86, no. 1 (October 2007): 100-144.

79. Anonymous expert, boxed beef interview, October 22, 2014.

80. Anonymous expert, countertop photocopiers interview, September 17, 2014.

81. Christensen, “Innovator’s Dilemma,” 3.

82. Anonymous expert, telecommunications (circuit and packet switched), July 30, 2015.

83. Anonymous expert, disk drive industry interview, October 15, 2014.

84. C.M. Christensen and S.D. Anthony, “Making SMaL Big: SMaL Camera Technologies,” Harvard Business School case no. 603-116 (Boston: Harvard Business School Publishing, 2003).

85. W.C. Shih, “Competency-Destroying Technology Transitions: Why the Transition to Digital Is Particularly Challenging,” Harvard Business School background note 613-024, August 2012, 9.

86. Ibid., 9.

87. C.E. Helfat, S. Finkelstein, W. Mitchell, M. Peteraf, H. Singh, D. Teece, and S.G. Winter, “Dynamic Capabilities: Understanding Strategic Change in Organizations” (Malden, Massachusetts: Wiley-Blackwell, 2007); and M.E. Porter, “The Five Competitive Forces That Shape Strategy,” Harvard Business Review 86, no. 1 (January 2008): 78-93.

88. R. Adner and D.C. Snow, “Bold Retreat: A New Strategy for Old Technologies,” Harvard Business Review 88, no. 3 (March 2010): 76-81.

89. FujiFilm Holdings Corp., “Annual Report 2014,” www.fujifilmholdings.com.

90. J. Alcacer, D.J. Collis, and M. Furey, “The Walt Disney Company and Pixar Inc.: To Acquire or Not to Acquire?” Harvard Business School case no. 709-462 (Boston: Harvard Business School Publishing, 2009).

91. “Clay Christensen on the Recent Debate,” June 27, 2014.

i. Specifically, our survey asked experts the following questions:

Part A) Please think back prior to the advent of [NAME OF DISRUPTIVE INNOVATION] (e.g., [EXAMPLE OF DISRUPTIVE INNOVATION NAMED]) in the [BASE YEAR]. (1) Prior to that, were there firms engaged in [NAME OF INDUSTRY] with significant market share (e.g., > 5%)? (2) Prior to the advent of [NAME OF DISRUPTIVE INNOVATION], were firms in [NAME OF INDUSTRY] improving in performance? (3) Did this improvement rate exceed what most customers could absorb (e.g., some say that word-processing software added features faster than most consumers could learn them)? (4) Prior to the advent of [NAME OF DISRUPTIVE INNOVATION], did firms in [NAME OF INDUSTRY] have the ability to create a simpler, lower cost, but profitable product that would appeal to current non-customers? Part B) Please now think about how older companies in [NAME OF INDUSTRY] responded to the emergence of [NAME OF DISRUPTIVE INNOVATION] (e.g., [EXAMPLE OF DISRUPTIVE INNOVATION NAMED]). (1) Did legal or contractual barriers prevent these incumbent companies from developing or adopting [NAME OF DISRUPTIVE INNOVATION]? (2) Did leading firms in [NAME OF INDUSTRY] flounder as a result of [NAME OF DISRUPTIVE INNOVATION]?

Coding: If any expert on a case responded to A1 or A2 “yes,” then we concluded leading companies with a trajectory of sustaining innovations existed. If the response to A3 was “yes,” then we concluded overshoot had occurred. If experts answered “yes” to A4 and there were no legal barriers (B1), then we judged that incumbents had the capability to respond. If experts responded “yes” to B2, we judged that incumbents had been disrupted. Note: In phone interviews, we explained that “floundered” could be interpreted as having lost significant market share. If multiple experts on the same case disagreed on the answer to a question, we gave the benefit of the doubt to the theory of disruption, and agreement with that element of the theory of disruption was judged confirmed.

View Exhibit

View Exhibit View Exhibit

View Exhibit

Comments (2)

Travis Barker, MPA GCPM

Harry Hawk